Understanding CFD Trading: What Every Trader Should Know

Understanding CFD Trading: What Every Trader Should Know

Blog Article

How to Make the Most of CFD Trading: Expert Tips and Strategies

Agreement for Difference (CFD) trading presents investors a distinctive method to business financial areas without possessing the underlying asset. It's obtained recognition for its flexibility and potential for large results, but like any trading process, it requires talent and understanding to succeed. Whether you're a beginner or looking to improve your technique, below are a few specialist methods and strategies to help you maximize of cfds.

1. Understand the Basics of CFD Trading

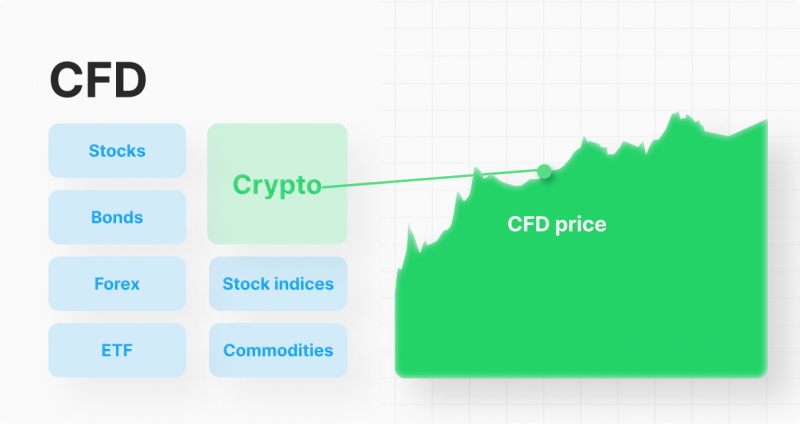

CFD trading enables you to speculate on the price movement of resources such as for example shares, commodities, forex, and indices. When you enter a CFD trade, you are accepting to exchange the big difference in the price tag on a tool between the time you start and shut the contract. This implies you can benefit from equally growing and slipping markets.

Before jumping in, it's essential to truly have a strong understanding of how CFDs work, in addition to the associated risks. Make an effort to familiarize yourself with essential phrases and methods such as spread, margin, and contract sizes to make informed trading decisions.

2. Use Flexible Control Correctly

One of the very most interesting features of CFD trading is flexible power, which allows traders to regulate larger jobs with an inferior capital outlay. Nevertheless, while leverage may increase profits, additionally it magnifies possible losses. Use leverage cautiously and guarantee you're confident with the level of chance it introduces into your trading.

3. Produce a Chance Management Strategy

A good chance management approach is a must in CFD trading. Generally set stop-loss requests to restrict possible deficits and protect your capital. Moreover, define the total amount of capital you're willing to chance per industry and adhere to it. Never chance significantly more than you can afford to get rid of, as trading inherently bears some level of risk.

4. Keep Up-to-date with Industry Information

CFD costs are very affected by market news and international events. Keeping up-to-date on economic studies, geopolitical developments, and industry emotion may assist you to assume value movements. Use reliable news options and consider integrating fundamental evaluation in to your trading technique to produce better-informed decisions.

5. Pick the Right Areas to Business

CFD trading supplies a wide range of markets to industry, but not all markets may suit your trading style. Some markets tend to be more unstable, providing larger potential gains but in addition higher risks. Others are far more stable, that might match risk-averse traders. Evaluate industry conditions and choose those that arrange along with your chance threshold and strategy.

Realization

CFD trading could be a gratifying experience when approached with information and strategy. By knowledge the basics, using power responsibly, handling risk, and remaining educated, you can boost your likelihood of success. Remember, trading is just a talent that increases with time and experience, therefore have patience and continue understanding as you go. Report this page